My subject today is on one of my personal favorite topics: budgeting. Teaching kids about money is an important part of raising responsible adults. That includes understanding how to manage money, how to spend smart, and how to budget!

Zach and I first read Dave Ramsey’s The Total Money Makeover years ago and it’s completely changed our lives in the best way possible!

Neither Zach or I were raised in very budget-conscious homes.

Not that our parents necessarily made terrible decisions with money, but we both had a LOT to learn when we got married and were on our own.

We want to equip our children with the power to control their money so it won’t ever control them!

Even if you have young children (our youngest is six) it’s never too young to start teaching kids about money!

Here are three ways you can easily help raise your children to have a healthy outlook about finances using the Dave Ramsey for kids method as a guideline:

Disclaimer: this post contains affiliate links.

Originally published February 25, 2016

Teaching Kids About Money Tip #1: Set the Example

It’s important for our children to hear us talking about money.

Not in a stressful way (which really isn’t ever happening anyway since we do have such a clear budget to follow each month!) but in an honest way.

Our kids know we don’t eat out often because we value vacations over eating out.

So we don’t spend money on eating out in order to afford family vacations.

Kye is able to buy lunch at school once a month and he understands the reason behind that decision: it’s cheaper (and healthier!) for Mommy to pack his lunch than it is for him to buy it.

It makes it easy to avoid buying random toys at the store because we can simply tell the kids “it’s not in our budget” and they understand what we mean.

Spending smart is a lifestyle.

It is something the entire family can participate in and will benefit from!

—–> Read how to set up your own family budget here!

Teaching Kids About Money Tip #2: Include them in Giving

Giving is SUCH an important part of our budget. We give to God FIRST.

We do this so automatically that it takes an effort for me to remember to discuss it with our children.

We allow them to see us giving and discuss with them that we are blessed because of God and that we always give to Him before having any money for ourselves.

We point out how that gift blesses others and helps others to know Jesus.

We give them opportunities to give as well and help them to feel the true joy that comes from having a giving heart and spirit.

Teaching Kids About Money #3: Tell Them Your Goals

Spending smart isn’t just about giving to the Lord and making wise choices in how we spend our money each month, it’s also about saving.

Zach and I are

We love long term goals and plans and find joy in working towards those goals.

One of our longterm goals is to own a family vacation home at the beach (Sidenote: we went for a Disney House instead haha!)

Our kids know about this goal and they understand that we have to save a lot of money in order to make this goal a reality someday (we are still working through the baby-steps so we aren’t saving at all for that house just yet!).

By sharing in our long term goal is helps them to understand the value of saving money.

Our family may have to make sacrifices now, but they will pay off for us all down the road.

While we have been having these conversations with our children since we started our own journey towards financial freedom a few years ago, it wasn’t until just recently that we got the kids started on earning their own money.

Teaching Kids About Money Tip #4: Pay Kids to Do Chores

Kye has had a big interest in earning money for a while now.

He started a bookmark business, he’s had a very successful lemonade stand as well as a watermelon stand.

He hasn’t ever spent a DIME of his own money.

When he asks for something and I tell him he can use his money if he’d like to purchase it b/c it’s not in Mommy’s and Daddy’s budget, he declines because he’d rather keep on saving it.

His long term goal is to save enough to buy the house next door to us for him and his future family (I love that goal!)

He opened his first bank account and loves getting his statements in the mail (although the penny he earns in interest isn’t too exciting!)

He reached a point where he kept asking about ways he could make more money and I just didn’t have any ideas.

I asked on Facebook and had a friend recommend Dave Ramsey’s Financial Peace Junior Kit. I purchased it (they sell a sibling set with extra parts for Britt!) as well as Smart Money Smart Kids.

I haven’t yet read the Smart Money, Smart Kids book but we have put the Financial Peace for Kids kit into action!

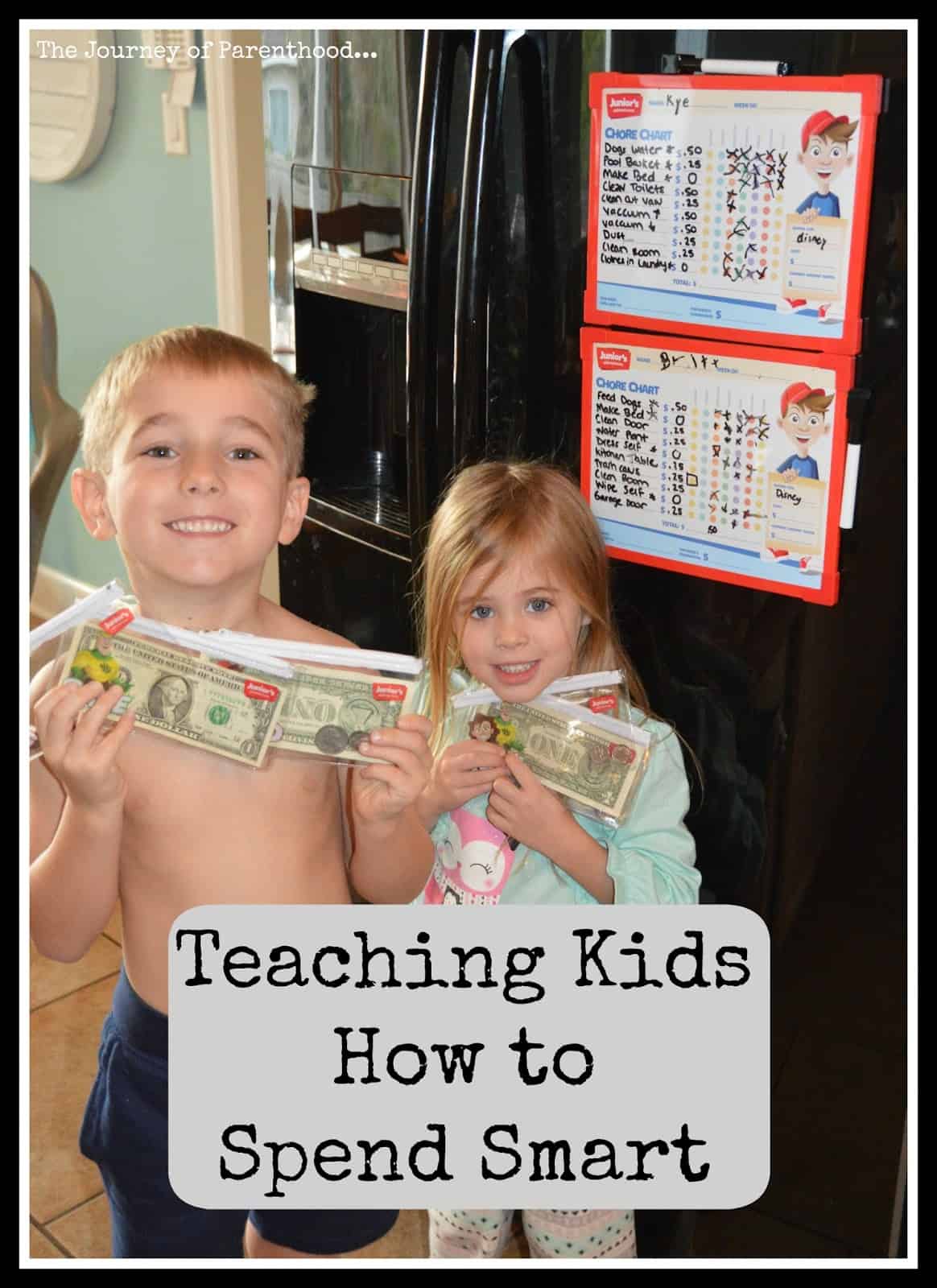

The kit comes with a great book for parents (VERY easy, quick read), a book for kids, a magnetic dry erase board chore chart (Dave Ramsey refers to this as the Junior Commission chart) and clear envelopes.

I read the parent book first then worked through the workbook with the kids.

They didn’t do any of the activity pages included in the workbook though, which go through Dave Ramsey’s Save Spend Give formula, as they really already have a pretty solid understanding of giving, saving and spending.

Yes, even Britt who just turned 4!

I was always anti-allowance for my kids.

I didn’t like the idea of them getting paid to do things around the house that they should do for free. I was SO impressed that Dave discusses this!

Zach and I worked together to decide on 10 things for our kids to do each week.

A few are “for free” meaning they don’t get paid to do them, but are expected to do them.

And then the rest of them earn a commission for them.

Zach and I agreed we didn’t want to spend a lot of our own money from our budget in order to give them money.

We know they will earn more as they get older (and their chores will become more difficult too!) but for

It has been AWESOME so far.

Not only have they been very motivated to do their chores but it’s helped in the “freebies” too.

Britt was struggling with wanting to dress herself and wipe herself and both of those items have become complete non-issues now that they are “chores” she does each day 😉

I did some research (thanks Pinterest) into figuring out

Our Chores

Here are Britt’s chores right now:

- feed the dogs (daily chore, earns $0.50 for the week if she does it each day)

- make bed (freebie, must be done daily but nothing earned)

- clean the windows in the living room area (once a week, $0.25 earned)

- water the only plant we have in our entire house (once a week, $0.25 earned)

- dress herself (freebie, must be done daily but nothing earned)

- clean the kitchen table (once a week, $0.25 earned) – my hope with this is that she’ll stop making such a mess while she eats if she’s the one cleaning it!

- gather all small trash cans around house on trash day (once a week, $0.25 earned)

- have bedroom completely cleaned (once a week, $0.25 earned)

- wipe herself when going potty (freebie, must be done daily but nothing earned)

- feed the cat (daily chore, $0.25 earned for week)

Here are Kye’s chores right now:

- give the dogs water (daily chore, earns $0.50 a week if completed daily)

- empty the pool basket (daily chore, earned $0.25 for week if completed daily)

- make bed (freebie, must be done daily but nothing earned)

- clean toilets (once a week – we have three toilets in our home – $0.50 earned total)

- clean out the van (once a week, $0.25 earned)

- vacuum the upstairs of our home (once a week, $0.50 earned)

- vacuum the downstairs of our home (once a week, $0.50 earned)

- dust the furniture in the living room and dining room (once a week, $0.25 earned)

- dirty clothes in the laundry (freebie, must be done daily but nothing earned)

- have bedroom completely cleaned (once a week, $0.25 earned)

How Our Kids Do Chores

As the kids get older we will change their chores but for now it’s been great!

We are working with Britt on having a “happy heart” while doing her tasks.

She’s the one that will put off doing her chores and then do them all at once.

Kye is the opposite. He’s so self-motivated and will try to knock out as many as he can earlier in the week to go ahead and have them done by the weekend!

Pay-Day is Sunday morning before church. They each have three envelopes. One for spending, one for saving and one for giving.

Zach pays them and explains each week about the importance of each envelope.

They take their “give” envelopes to church services and both get so excited to put their contributions in the baskets!

Britt LOVES to give to the Lord and she has asked if she can take some from her spend money so she can give extra to God 🙂

Both kids decided to save their money for our upcoming Disney trip.

They are SO excited to spend it on some special snacks that they normally wouldn’t be allowed to purchase!

We don’t do a lot of “extras” at Disney (we try to do our vacations as cheaply as possible) so it’s a great thing for them to save for and will be an awesome reward for them for their hard work so far!

Final Thoughts on Helping Kids Manage Money and Spend Smart

I want to leave such a legacy for our children.

Our main goal as parents is to lead them in the path of the Lord but I also want to raise them to understand money and how to properly manage money.

I want for them to be hard-workers and great savers and smart spenders and especially happy givers!

What ways are you teaching your kids how to spend smart? Do your kids do chores?

I’d love to know their ages and what chores you have them do!

I’m always on the lookout for ideas!

- A Letter to my Son on His 16th Birthday From Mom (Kye’s Bday Letter) - March 20, 2025

- Open Letter to my Daughter on her 12th Birthday – Love, Mom {Britt’s 12th Bday Letter} - January 16, 2025

- Letter to My Son on his 6th Birthday – Love Mom - January 8, 2025